The prime rate determines your iLOC interest rate for variable rate lines of credit. Inclined adds or subtracts a margin to the prime rate based on your credit limit. As the prime rate changes, your iLOC rate adjusts, affecting your monthly interest.

The prime rate is a key factor in determining the interest rate on your Inclined Line of Credit (iLOC). This article explains what the prime rate is and how it affects your iLOC.

What is the prime rate?

The prime rate is the interest rate that commercial banks charge their most creditworthy customers, typically large corporations. It serves as a benchmark for many types of consumer loans, including our lines of credit (iLOCs) at Inclined.

Key points about the prime rate:

- It's largely influenced by the federal funds rate set by the Federal Reserve.

- Major banks usually change their prime rates in unison.

- The Wall Street Journal publishes the most widely used prime rate - Inclined utilizes this rate for variable rate iLOCs.

- You can find the current prime rate on The Wall Street Journal's Market Data Center page: https://www.wsj.com/market-data/bonds/moneyrates

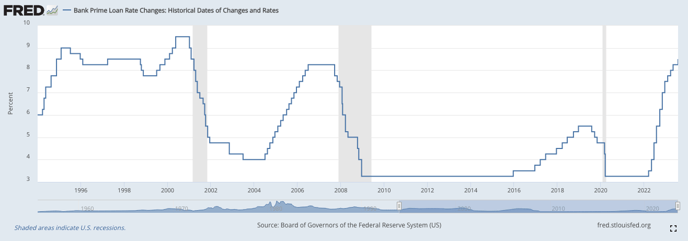

A historical chart showing the prime rate variability:

*As you can see from the St. Louis Fed chart above, the prime rate is a variable rate that changes up or down over different time periods.

How does the prime rate impact my iLOC?

Your iLOC interest rate is directly tied to the prime rate. Specifically:

- Base rate: Your iLOC rate starts with the prime rate as its base.

- Margin: Inclined adds or subtracts a fixed margin to the prime rate based on your iLOC credit limit to determine your actual rate.

- Variable rate: As the prime rate changes, your iLOC rate will adjust accordingly.

For example, if the prime rate is 8.5% and your margin is -0.50% (or -50 basis points), your iLOC rate would be 8%. If the prime rate decreases to 8.25%, your new rate would be 7.75%.

When does my rate change?

Your iLOC rate adjusts immediately after a change in the prime rate becomes effective, usually the day after it is announced.

Understanding rate changes:

- Rate increases: If the prime rate goes up, your iLOC rate and monthly interest accruals will increase.

- Rate decreases: If the prime rate goes down, your iLOC rate and monthly interest accruals will decrease.

Remember, while the prime rate influences your iLOC rate, the credit limit on your iLOC determines which margin is added or subtracted from the prime rate.

How do I view my latest interest rates on my iLoc?

If you are a policyowner with an Inclined line of credit (iLOC), please log into your Inclined account at https://www.inclined.com/sign-in and click on “Policyowner sign in” and enter your login credentials which will then take you to account portal home page which shows you your current interest rate on your iLoc.

If you are an advisor, please log into your Inclined account at https://www.inclined.com/sign-in and click on “Advisor sign in” and enter your login credentials which will then take you to your advisor portal home page which shows you our current rate table based on line size.

For specific questions about your iLOC rate, how changes in the prime rate might affect your account, or what rate tier you qualify for based on your iLoc credit limit, please contact our support team at support@inclined.com

.png?height=120&name=HubSpot%20Featured%20Image%20(1).png)